How to invest in the stock market?

Investing in the stock market is similar to investing in a business. But instead of building that business from the ground up, you become its owner, partially, through your purchase of its shares in the stock market. This allows you to grow your money two ways.

- Dividends: A well-performing business will generate considerable profits and turn that money into consistent dividend payouts.

- Price differences: If a company maintains a strong performance, its stock price will keep rising. You can take advantage of this by buying its shares at the fair value and hold them for as long as possible to benefit from the price difference.

As you can see, investing on the stock market is the same as investing in a normal business: it’s crucial to understand what the company does in order to maximize gains. If you make sure the corporation you’re invested in can maintain steady growth, there’s no doubt its stock price will keep up and increase over time, and you’ll be reaping those gains for as long as you own the company.

The most successful investor on the stock market?

There’s no arguing that Warren Buffett is one of the most successful and respected investors in history. The 80-year-old self-made billionaire has reached a net worth of US$76 billion following a long-term investment approach known as value investing. The strategy requires an analytical understanding of a company one wishes to buy as well as the knowledge of its fair price in order to purchase its shares at a discount (below the fair price). After 50 years of carrying out this approach, Buffett has produced a compounded annual return of 22.38% (at this rate, US$100,000 will become US$2.5 billion in 50 years). His strategy is no secret; thousands of books have been published on this subject, and they all point to this one big core idea: Buy a wonderful company at a fair price.

Why can’t most people follow Warren Buffett’s investment approach?

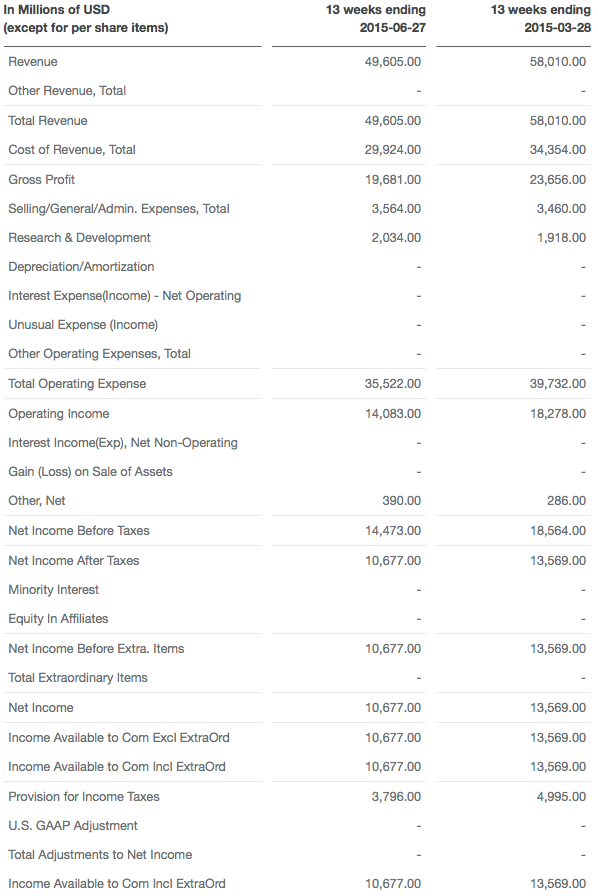

To buy a wonderful company at a fair price, you need to know if a company is wonderful and what exactly its fair price is. That means you need to read the financial statements, make sense of those numbers and come up with your own analysis of the company’s quality and competitive competence. You also have to conservatively evaluate the company in order to specify its fair price. The financial statements are the only legitimate source of information in this case; you can’t escape it.

Plus, reading financial statements on a regular basis helps you keep track of the performance of the company’s management. If there are significant changes in its fundamentals, you will be able to catch them and get rid of bad investments before disaster strikes.

Why people fail to follow Warren Buffett’s investment approach:

- Reading financial statements requires accounting knowledge and considerable experience in order to cultivate a thorough understanding of a company’s operations. All of which is difficult for beginners.

- There are hundreds or even thousands of companies on any single stock exchange. To find a wonderful company that would make a good investment, you'll need to read all of their financial statements to figure out which company qualifies as a great investment.

- It is hard to evaluate the fair value of a company. There are so many formulas, variables and methods needed to be considered. Plus, you need to calculate the fair price for every single company in the market to find out the undervalued ones.

- The company’s quarterly financial statements needed to be analyzed on a quarterly basis to make sure the company is still performing well and to check whether its fair price has changed.

No wonder why following Buffett’s footsteps—buying a wonderful company at a fair price—isn’t easy to do! Though that’s no longer the case with the help of Jitta.

Find a wonderful company with Jitta

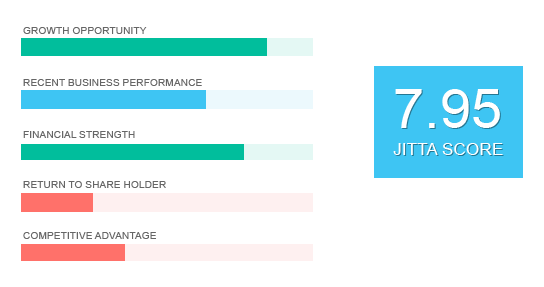

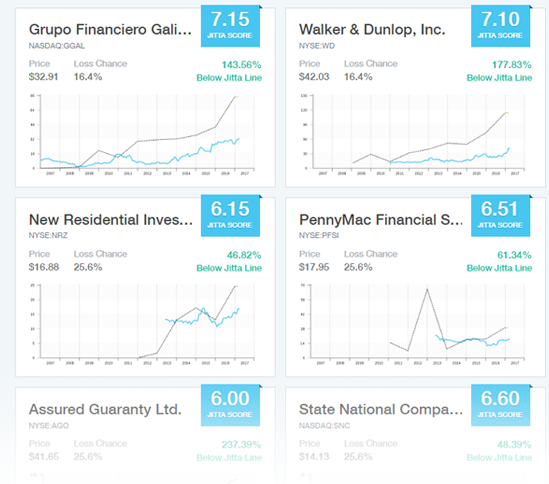

Jitta analyzes a firm’s operational ability and business sustainability using 10 years of financial statements, plus additional financial information, and comes up with Jitta Score. A company can be scored anything from 0 to 10, with 10 representing a highly desirable company. In fact, anything above 8 is considered a great business, whose growth opportunities, recent business performance, financial strength, competitive advantage and returns to shareholders are at a stellar level. By investing in higher-Jitta-Score companies at their fair prices, your wealth will grow along with the growth of the businesses.

According to Jitta, a wonderful company employs the following qualifications:

- Strong brand The company offers products or services needed by the masses. People are attached to its brand, which means it can keep raising the prices of its goods—hence, increasing revenues—without the fear of losing its customers.

- Economy of scale The company is able to keep the costs down while expanding its business. This gives it more advantages over its competitors and makes it harder for other firms to steal its market share.

- Cash income The company has high levels of working capital and is able to expand its business with very little additional investment. Its expansion plan is also clear and conservative.

- Secure financial status The company has positively high shareholders' equity, carries very little debt and does not take out loans beyond its pay-back capacity.

- Great management team The management shares the same point of view as the shareholders and continuously maximizes shareholders’ wealth through business expansion, dividend payouts and share repurchases.

Don’t forget the consistency!

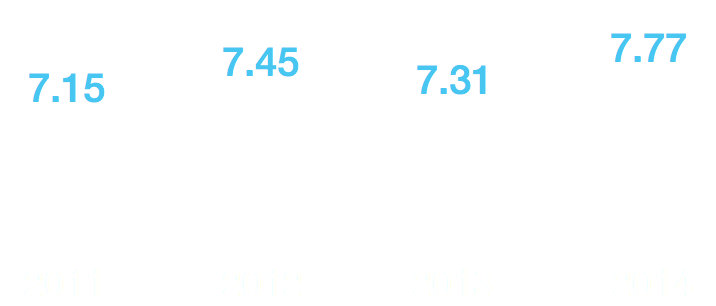

Jitta Scores are calculated and displayed per annum to measure the company’s stability and operational consistency. A wonderful company should always have a Jitta Score higher than 5.

Determine a company’s fair price with Jitta Line

Jitta calculates a stock’s fair price or fair value based mainly on its business performance instead of its market price.

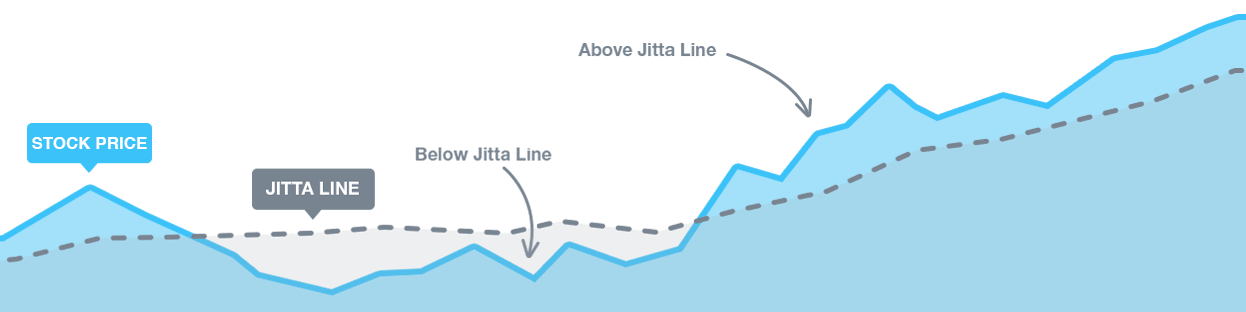

Jitta Line represents the price you should be paying for a stock in order to break even in 10 years and is calculated from the firm’s cash flow and assets. If the company has been earning $1 million every year for the past few years, its fair price would be $10 million at minimum.

Theoretically, the fair price or Jitta Line of a wonderful company will continue to rise in keeping with the firm’s business growth.

When the market price of a wonderful company hits below Jitta Line, it’s time to buy. Investing in these wonderful companies at a fair price helps you make long-term gains, for the stock price will continue to rise and your wealth will continue to grow.

Below Jitta Line

When a stock’s market price is below the Jitta Line, the stock is trading below its fair value. For example, “25% below Jitta Line” means the stock’s market price is 25% below its fair value—you’re getting a good discount. So consider buying the firm’s shares.

Above Jitta Line

When the stock’s market price is above the Jitta Line, the stock is trading above its fair value, a signal that this is not yet the time to buy. Buying shares of a wonderful company can be a bad investment if the price is too high.

Also if the firm’s Jitta Line is descending even though its price is still above Jitta Line, you might want to consider selling the stock.

When you invest in a wonderful company at a fair price, you can turn $9,000 into $4,400,000 in just 25 years (28.2% annualized returns) without having to trade the stock—as long as the business keeps growing and maintaining its competitive edge. If you want to minimize effort and maximize returns, investing in a “wonderful company at a fair price” should form the core of your long-term investment strategy.

Finding those gems on Jitta is super easy. Jitta has already ranked every single stock listed on various exchanges according to Buffett’s “buy a wonderful company at a fair price” principle. This classification system is called Jitta Ranking, which is determined by the Jitta Score and Jitta Line of each stock, plus the stock’s recent business performance. More emphasis is placed on Jitta Score to make sure that top-ranked companies are, first and foremost, wonderful before even considering their fair prices. Jitta also takes into account a company’s recent performance to screen for stocks with higher growth opportunities. Sometimes you’ll see stocks with a high Jitta Score trailing behind stocks with a lower Jitta Score. That’s because those higher-scored companies have smaller rates of growth than lower-scored ones, thus less lucrative for investment.

Find stocks with Jitta Ranking

On our Home page you’ll find two main sections: Explore by Country and Playlist. Explore by Country contains data of stocks listed in their respective countries. Click on the country you want to invest in and see all its stocks ranked by Jitta Ranking, from left to right and top to bottom. To see more information, like Jitta Factors and Jitta Signs, just click on each stock card.

Investing according to Jitta Ranking

For those not keen on in-depth stock analysis, allocating an equal amount of capital to each of the first 30 stocks on Jitta Ranking (from left to right, top to bottom) can help you achieve better returns. You keep those 30 stocks in your portfolio for 12 months, then come back and take a look at Jitta Ranking again. Companies that no longer make it to the top 30 should be liquidated and replaced by top-30 newcomers. Don’t forget that each stock must be allotted the same amount of capital as well. This is called rebalancing and you’ll need to do this to your portfolio every 12 months to diversify risk and maintain stable growth.

Jitta Ranking Yearly Returns

| TOP 5 | TOP 10 | TOP 20 | S&P 500 | DOW JONES | |

|---|---|---|---|---|---|

| 2009 | 24.55% | 34.74% | 33.16% | 23.45% | 18.82% |

| 2010 | 29.72% | 37.73% | 29.67% | 12.78% | 11.02% |

| 2011 | 0.04% | 2.00% | 1.67% | 0.00% | 5.53% |

| 2012 | 2.64% | 7.09% | 4.86% | 13.41% | 7.26% |

| 2013 | 50.56% | 42.10% | 46.67% | 29.60% | 26.50% |

| 2014 | 32.96% | -1.06% | 15.38% | 11.39% | 7.52% |

| 2015 | -7.19% | -13.72% | 4.03% | -0.73% | -2.23% |

| Annualized | 11.97% | 14.63% | 14.29% | 9.54% | 13.42% |

| Total Gain | 5.89% | 14.40% | 19.07% | 19.42% | 25.08% |

Jitta Ranking returns

Jitta has been back-testing Jitta Ranking algorithm since 2009 and found that investing with Jitta Ranking yields 184% higher annualized gain than investing in the S&P500. This means Jitta’s algorithm can really be applied to your investment for better returns.