“The way to look at a business is, “Is this going to keep producing more, and more, and more money over time?” And if the answer to that is yes, you don’t need to ask any more questions.”

– Warren Buffett

To invest in order to build long-term wealth, one must invest in assets that have the ability to increasingly generate cash flow year after year.

Therefore, when you invest, pay the most attention to the cash flow that that asset is able to create. Do not just look at the difference in the asset’s price and your capital gain, because in the long-run, assets that can generate increasing cash flows will benefit us in the far future.

An important perspective regarding this topic is mainly looking at the Passive Income.

Let’s think about buying and selling an asset and profiting from capital gain. Even though you’re profiting quite nicely, this gain is still part of the Active Income. Everyday, we are making our Active Income, but because we only have 24 hours in a day, we are bounded by time -our Active Income is limited. The stress and tiredness of actively seeking assets to buy and sell will take their toll, and we would increasingly find that there are less and less assets for us to invest in, hence our wealth would also decrease.

On the other hand, if we are able to invest in an asset that is able to generate a steady flow of cash on its own, then this would be our Passive Income. Because we have the same 24 hours to work, but we also have this other asset that is also working alongside us for 24 hours. In the future, if we have 10 of these assets, then it is like we have 240 hours per day (without even factoring in the time of ourselves that we can use to work or do other things)

If we look at all the billionaires in the world, who have increasing wealth every year, most of their assets are ones that generate increasing cash flows, in which they have kept for tens of years. We almost never find people who become wealthy from buying and selling their assets often.

Let’s look at an example of how investing in a cash-flow generating asset makes your life easier.

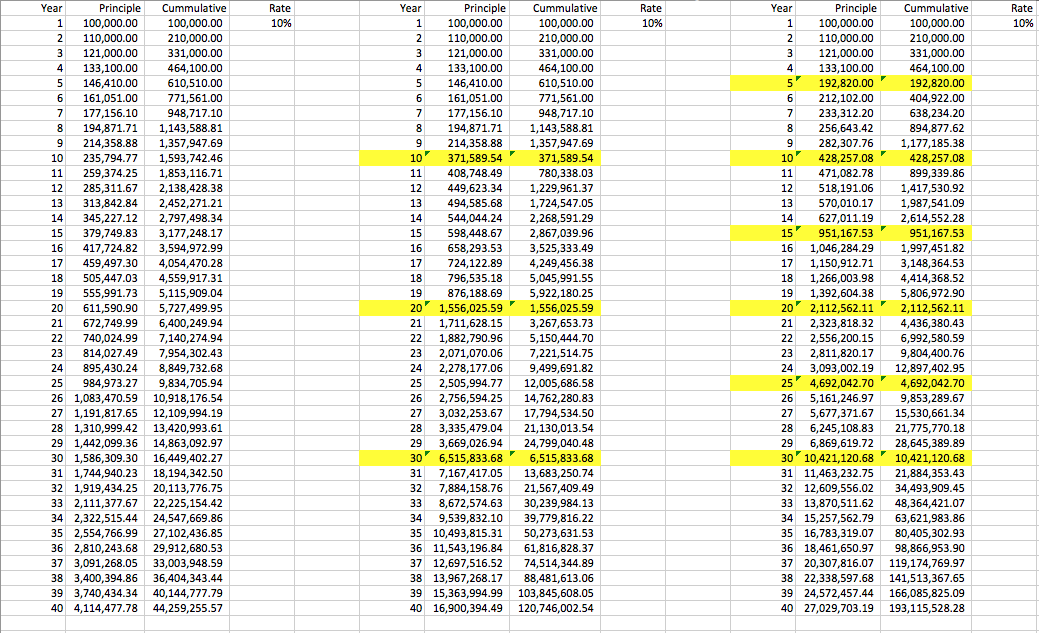

Let’s say we invest 1,000,000 Baht in an asset that can generate a cash flow of 100,000 Baht, which increases 10% every year.

- Situation 1 : If we hold onto this asset for 30 years, it will have a value of 15 million Baht, and will generate 1.5 million Baht for us each year. If we don’t use that money at all, we will have around 16.5 million Baht of cash.

- Situation 2 : We take that cash and invest in other assets that produce the same returns as the first asset (10% cash flow and growth every year), and we invest every 10 years.

In 30 years, we will have 65 million Baht worth of assets that can produce 6.5 million Baht cash for us per year, and will continue to grow. All of this comes from our decision to invest only 4 times in life.

- Situation 3 : We do the exact thing as Situation 2, but this time, we invest every 5 years.

In 30 years, we will have 104 million Baht worth of assets that generate 10.4 million Baht for us per year and continue to grow. All this wealth coming from making the decision to invest 7 times in life.

Therefore, if we understand the concept of Passive Income and know how to pick out good investments to a certain extent, we can live happily and wait for a few good investment opportunities in life in order to build our long-term wealth. On the contrary, those who aim to profit from capital gains in the same 30 years might have to spend their time searching for information, being busy buying and selling countless of times.

And say, even if we stopped investing altogether, our assets would still be generating cash for us, whereas if the people who make money from capital gains stopped, their wealth-generation would stop as well.

As a final note, I would like to emphasize that everything comes from your first investment in the good asset, allowing you to take your cash to invest in other things. Imagine if you had invested 1 million Baht into that asset and a year later, sold it off just because it went up to 1.5 million Baht.

Therefore, every time you invest, try to consider it from a cash flow point of view. It really would make your life much simpler and happier in the long-run.