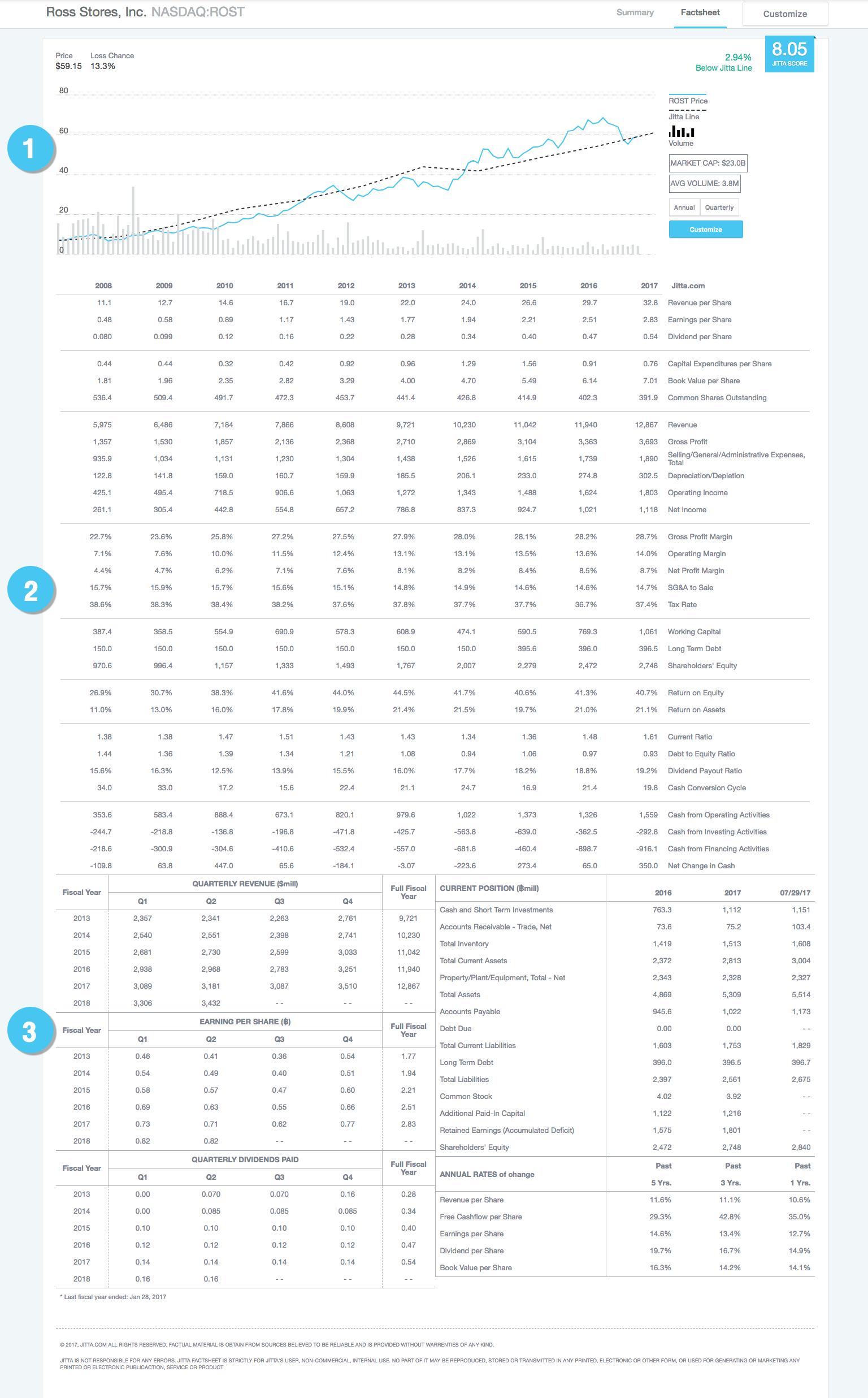

Jitta FactSheet

It’s time you ditch those spreadsheets for good. Jitta has made reading financial statements simpler, faster and more convenient with intuitive data visualization, clean interface and user-friendly design. Follow these steps to start analyzing fundamentals like a pro today.

Notice the FACTSHEET tab right next to SUMMARY.

You’ll see three main sections in FACTSHEET:

- Chart

- Financial data and ratios

- Data summary

Note: If you’re viewing Jitta FactSheet on your smartphone, we recommend you switch to a horizontal display and make sure the screen resolution is at least 375x667.

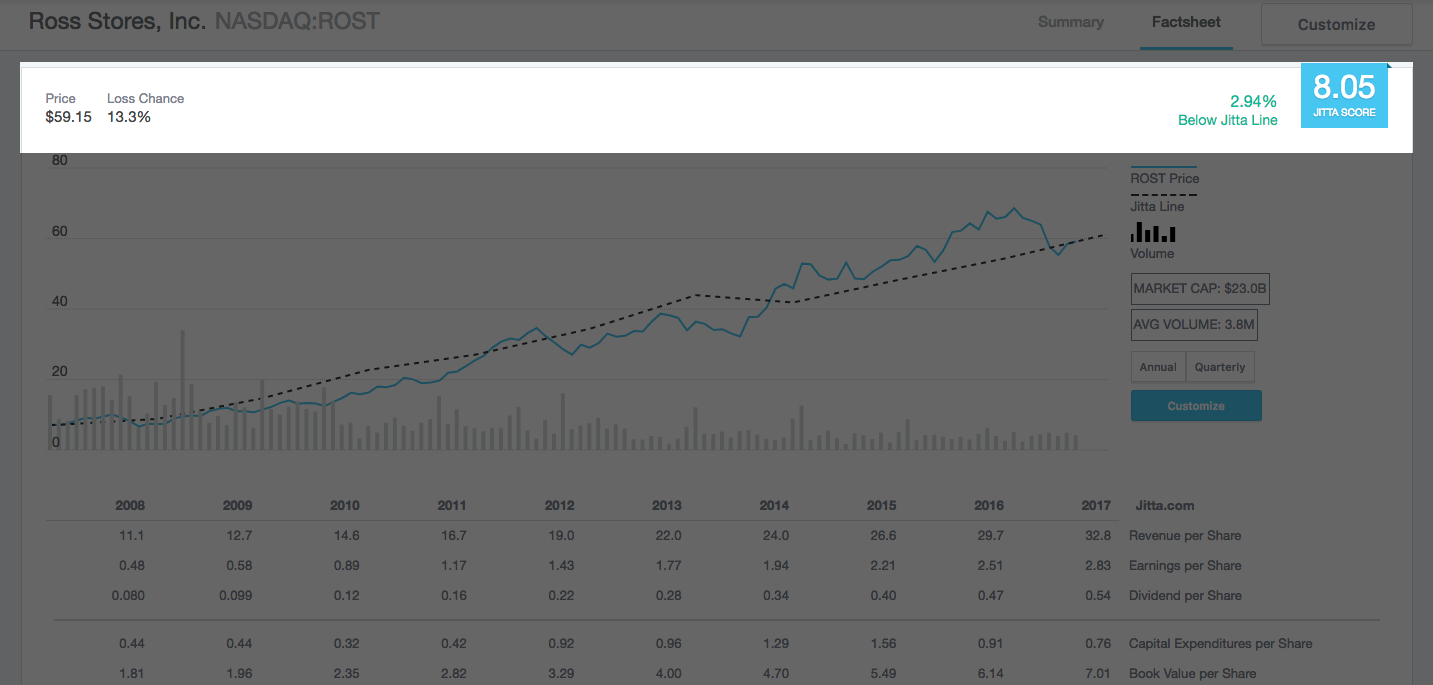

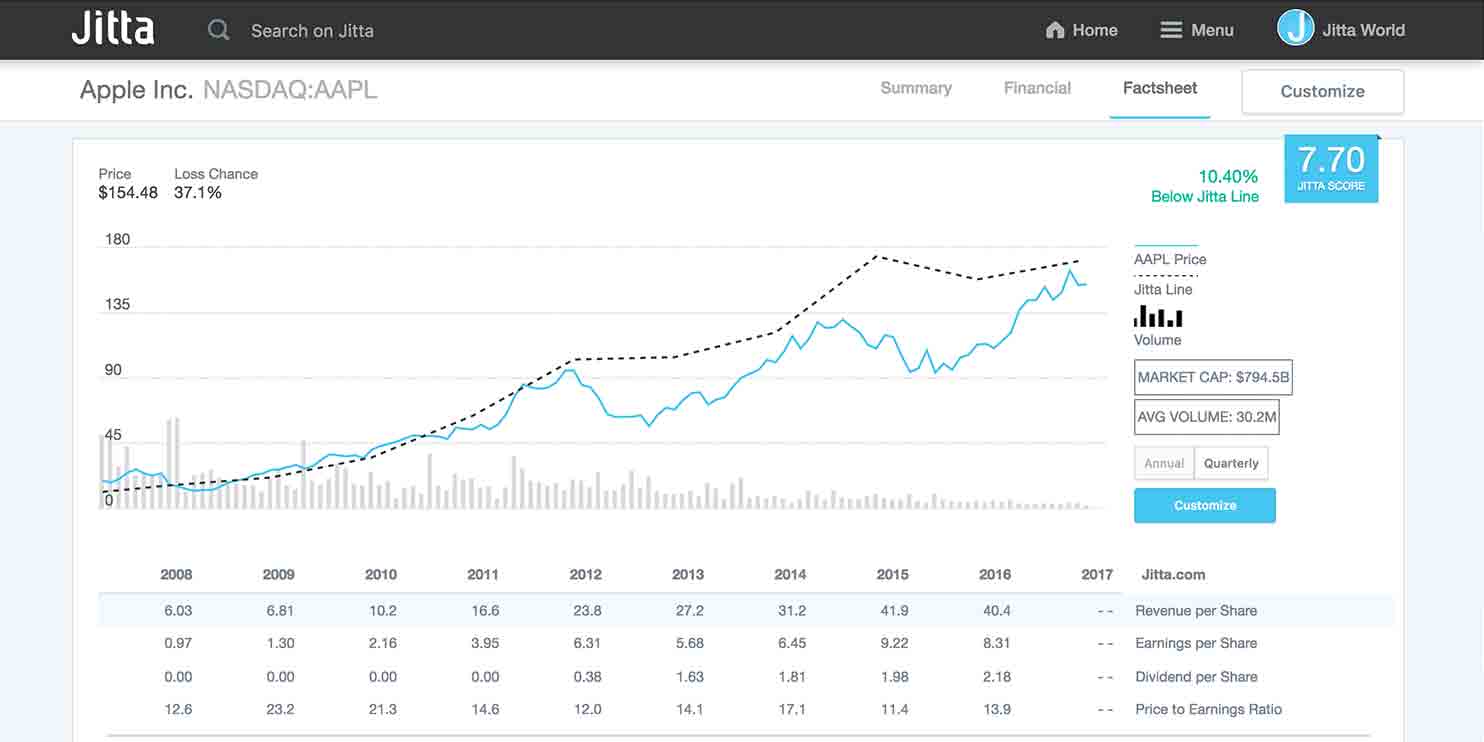

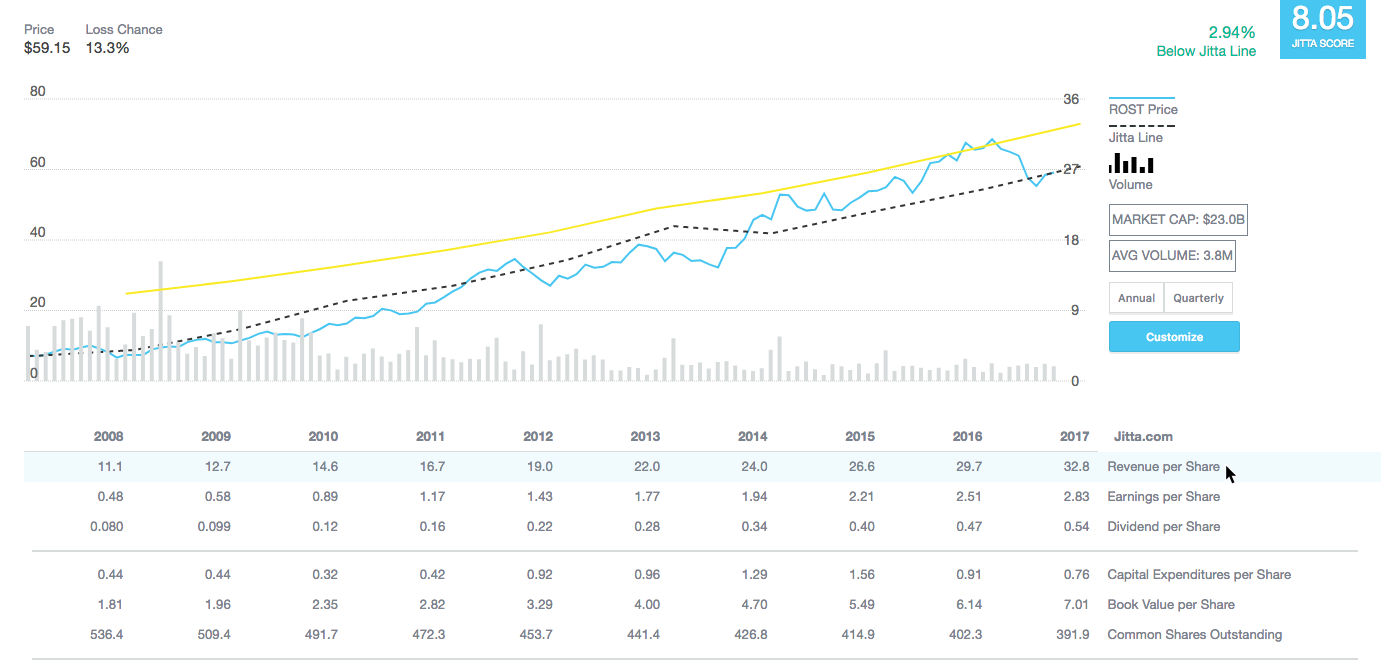

At the top of the page, you’ll find the stock’s Jitta Score, Loss Chance, current price and price in relation to Jitta Line (% below or above Jitta Line).

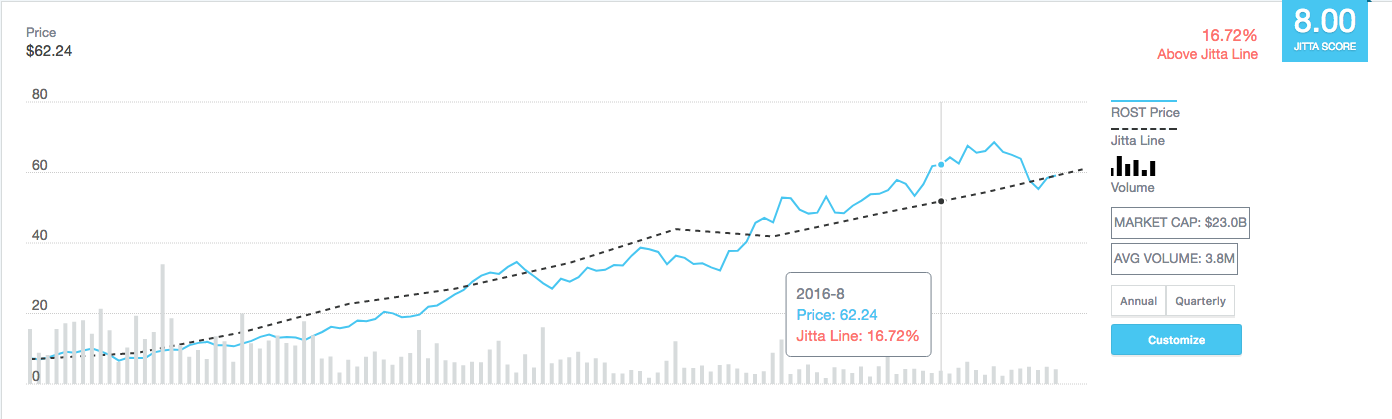

Now, take a look at our simple chart containing visual representations of Jitta Line (dash line), the stock price (blue line) and the trading volume.

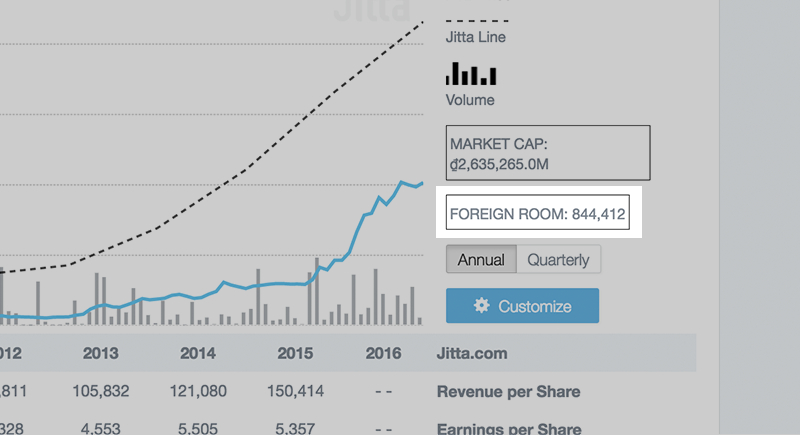

To the right of that chart, you will see the stock’s market capitalization and average volume. For Vietnamese stocks, there’s also FOREIGN ROOM, which indicates how many shares are still available for purchase by a non-Vietnamese.

The ANNUAL and QUARTERLY buttons allow you to switch between the past 10 years and the past 10 quarters of financial data.

When it comes to reading numbers, Jitta FactSheet has made it easy on the eyes—and brain! Just hover your cursor over any of the financial indicators in our interactive table and the whole row will be highlighted.

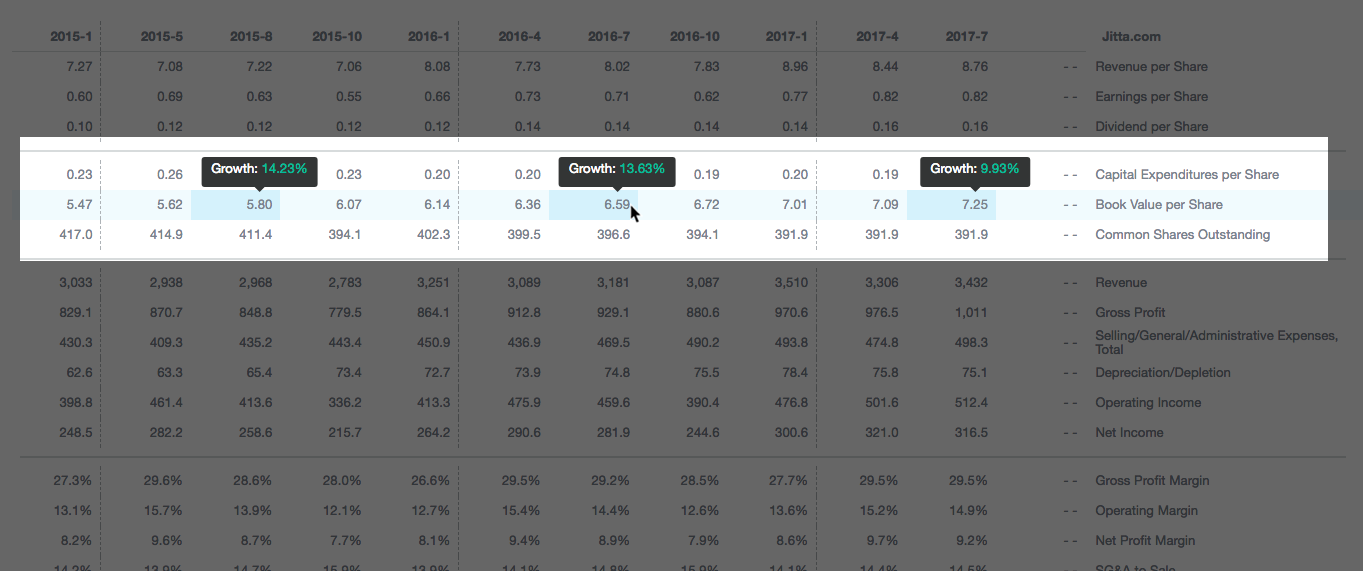

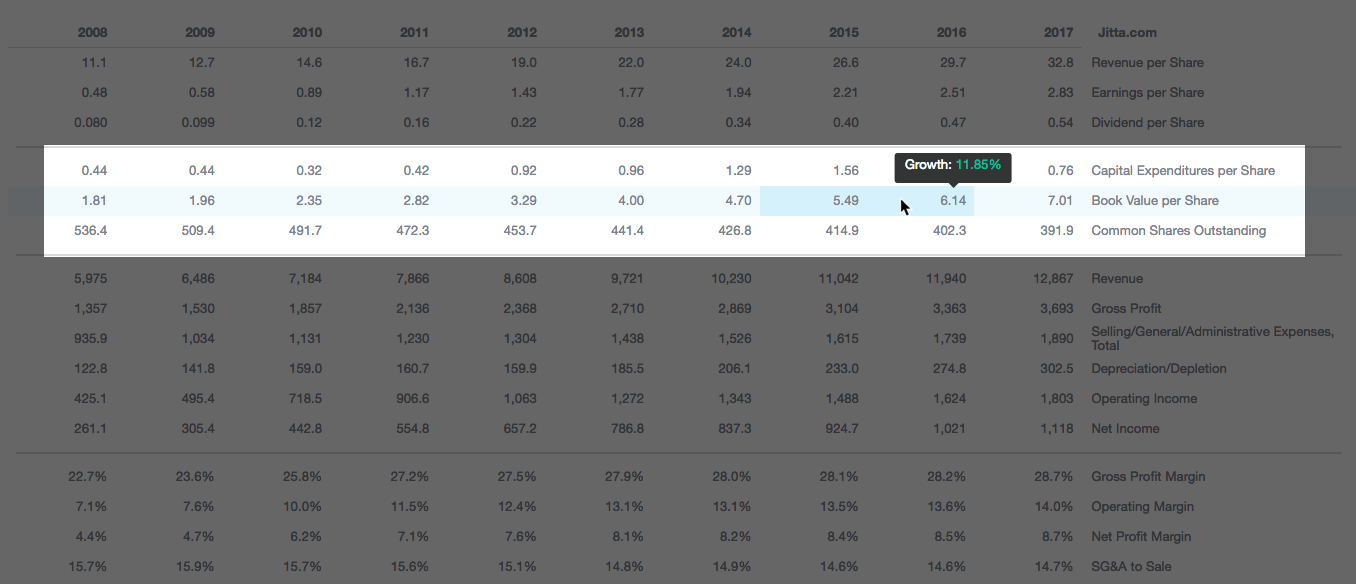

Now move your cursor over to any of the numbers in the table. You will see multiple numbers being highlighted: one is the number behind your cursor; others are the numbers you should be looking at for comparison. A black pop-up will also appear to show you the percentage of difference from one number to the next.

In the case of annual data, the numbers from two consecutive years are highlighted. This year’s number will be compared with last year’s, and last year’s will be compared with that of the year before, for example. When you switch to the quarterly mode, the numbers produced in the same quarter of consecutive years are compared, which means the number from Q1 this year will be compared with the number from Q1 last year and the year before.

Click on any rows and you’ll find their data translated into a line on the chart above, alongside Jitta Line, current price and volume.

You can remove any lines on the chart by clicking the corresponding rows again until the blue highlights disappear.

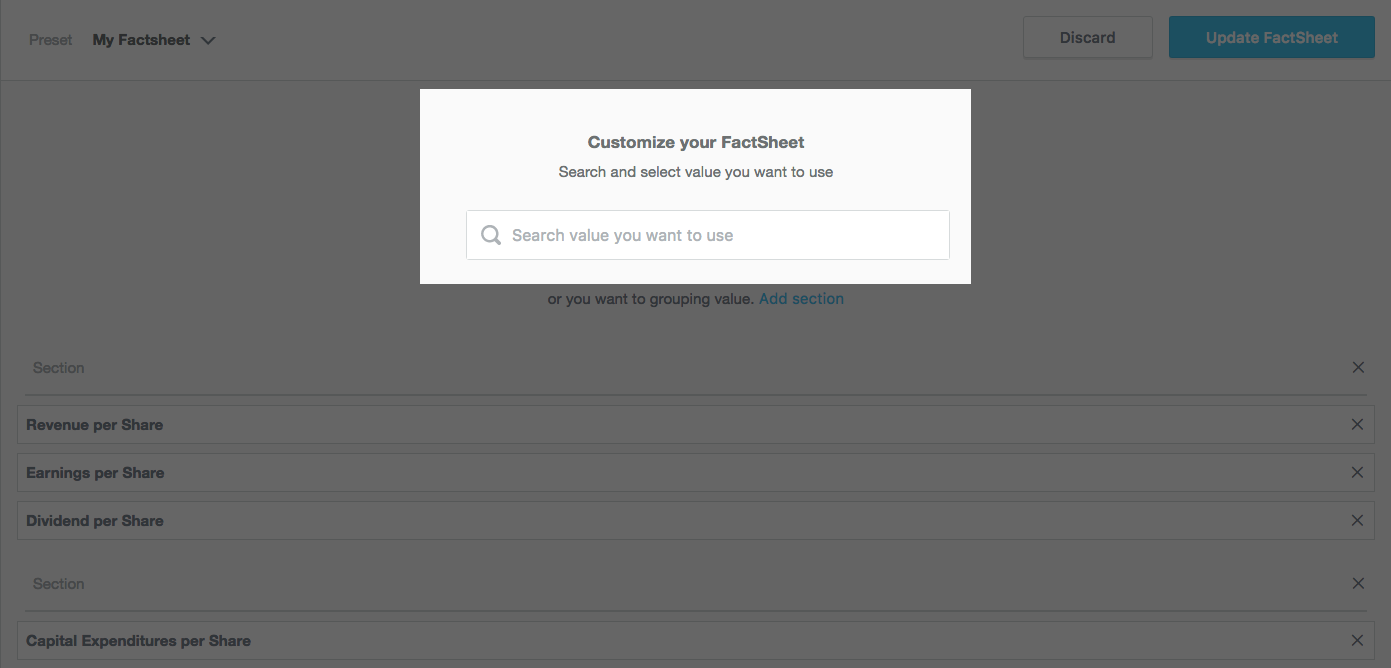

If you can not find certain absolute numbers or ratios, click the blue CUSTOMIZE button to create your own FactSheet.

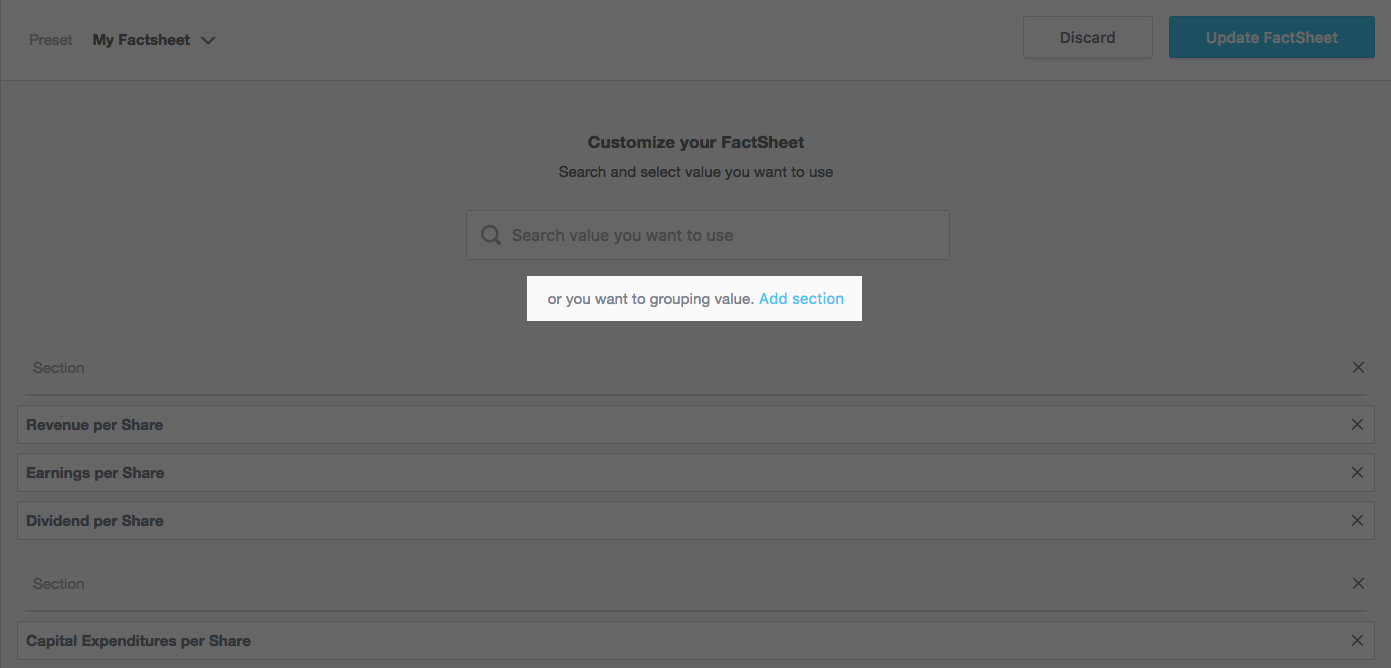

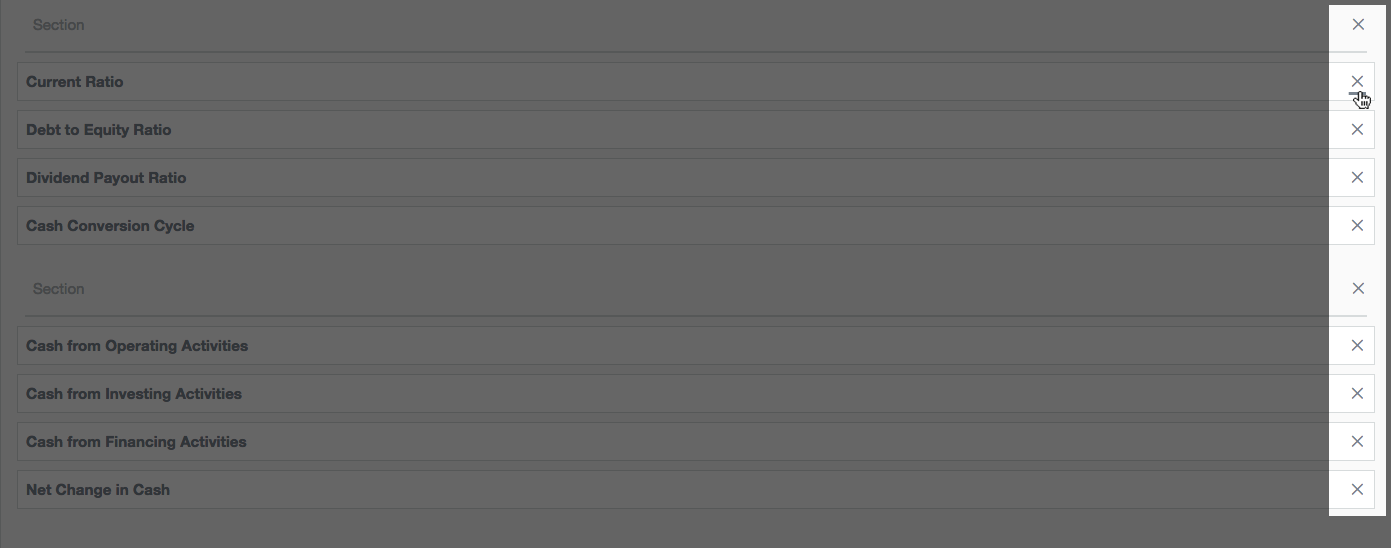

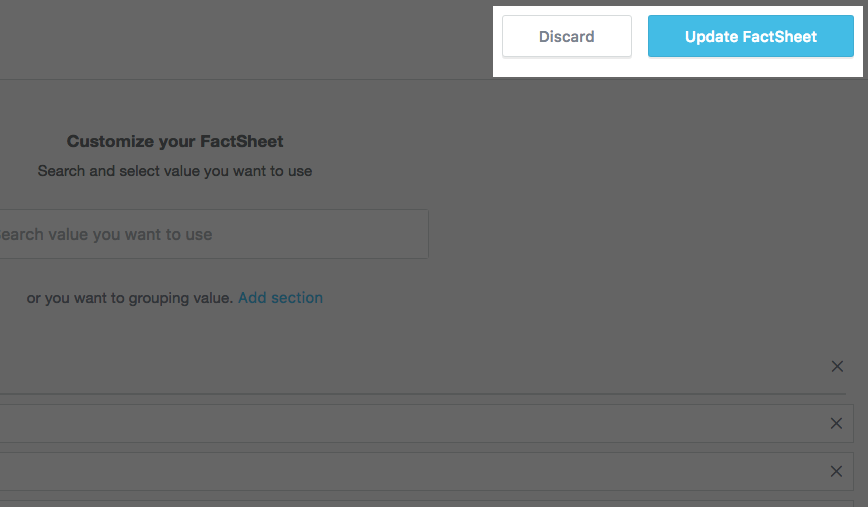

Once you hit CUSTOMIZE, a search box will appear at center of your screen. You can search for an indicator by typing its name.

A search box will appear in center of a page. You can search for an indicator by typing its name. or by category:

Note: If you can’t find what you’re looking for, please let us know at wonderful@jitta.com. We will add them to the database as soon as possible—just for you.

Now your indicator is in the FactSheet! You can move it around and place it wherever you like.

If you’d like to create a new section for important indicators, just click ADD SECTION right below the search box.

To delete any indicators or section lines from your FactSheet, click on the X mark.

When you’re done organizing your FactSheet, you can save it by clicking the UPDATE FACTSHEET button at the top right corner of the window.

To go back to Jitta’s default FactSheet, by choosing it in the drop-down menu on the upper left side of the window.

To exit the window, click DISCARD to reset or UPDATE FACTSHEET to save.

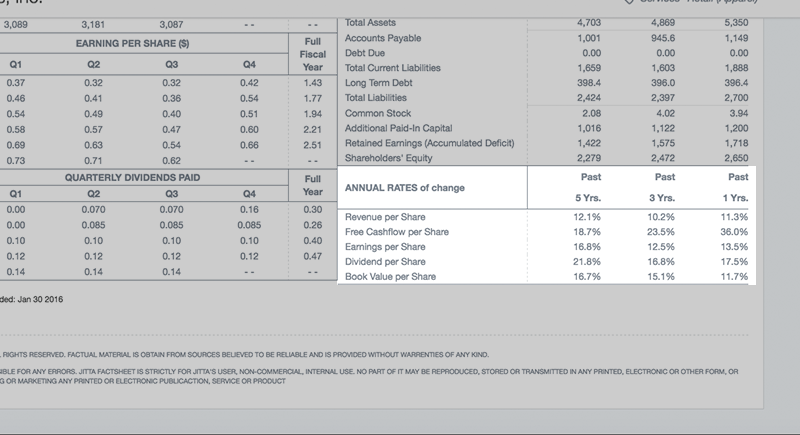

At the bottom of the page, in the summary section, you’ll find a table labelled ANNUAL RATES OF CHANGE. The data shown in this table are one-, three- and five-year average changes in key ratios, and should hint at the firm’s business outlook. If the average rates of change are larger for the past one or three years than they are for the past five years, you can hypothesize that the company is experiencing a growth-surge of some sort. If the short-term rates are smaller than the long-term rates, you may assume that the company hasn’t been performing well lately.

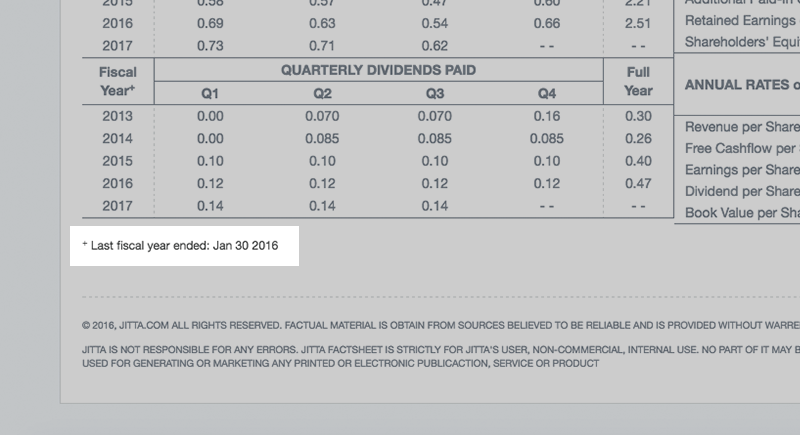

This tiny note at the bottom of the table tells you whether the company closes its books at the end of the calendar year, in December (Google), or at any other times as decided by the management (September for Apple, January for Walmart). Read more about calendar year and fiscal year here.

We told you reading financial statements aren’t as cryptic as you think. Have fun analyzing stock fundamentals!