When I first started driving, my mom would always remind me not to drive too fast. She would say the traveling time between driving at a 100 km/hr speed and 120 km/hr is not that different. So really speeding up isn’t all that worth it if an accident happens.

It’s the same for investment. In the long-run, it is not worth it to do something risky for short-term returns.

Why?

- We may hit the mark sometimes and gain great returns, but at the same time, when we make mistakes, the stakes are equally high. And the feeling of gaining great returns doesn’t compare with the feeling when you lose the same amount. Trust me.

- Making too-risky investments creates stress. So much that sometimes it physically affects us. We can’t eat, we can’t sleep. Not ideal.

- In the game of investment, Game Over happens when our entire invested capital is gone. If we take on too much risk and made a mistake, we could lose almost our entire original capital. This is like driving too fast and having a near fatal accident, which is so not worth it for driving fast and getting there a few minutes earlier.

- Investing is something we are doing for the long-term, for the rest of our lives. History has already shown us that no matter which technique used, in the end the compounded return is around 20% per year. So rushing to make fast money with high risk versus investing carefully in the long-run will generate you the similar results. The only difference is how you would feel throughout the entire journey.

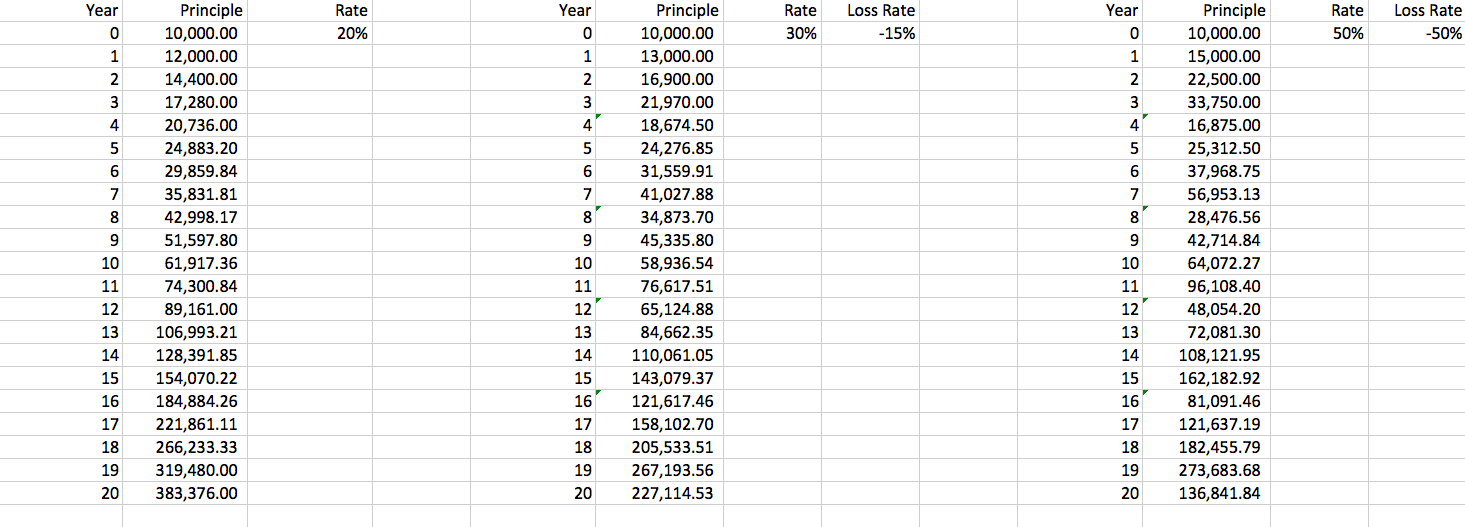

I’ve created an Excel sheet here so that it’s easier to see that making only a few big losses might actually significantly decrease your returns. I’ve created three hypothetical situations here:

- A low-risk investment strategy will generate a 20% return per year. With an starting capital of $10,000, 20 years later it will become $383,376.

- A moderate-risk investment strategy will generate a 30% return. However, when making a loss it will be a 15% loss. So let’s say that in every 4 years, 3 years will profit and one will make a loss. We will find that the original $10,000 becomes $227,114.53.

- A high-risk investment strategy will generate a 50% profit each time of profit, however, it will also make a 50% loss. With the same 4-year situation of making a loss once every four years, after 20 years the starting $10,000 will be a mere $136,841.84.

Clearly, we can see that even though a high-return investment strategy yields a 50% profit each time, every time you make a loss, it is also equally significant. And in the long-run, this strategy generates the least return, not to mention all the time and stress that we have to waste in doing so.

And so this sums up the simple rules of investment by Warren Buffett, who suggests: 1) Don’t make a loss and 2) Read #1 again.

If we don’t make big losses, then we will be able to make compounded returns constantly and accomplish our investing goals. By just making a 20% return per year, we can change our 1 million into 100 billion within 25 years.

And believe me, looking at our money growing 20% per year every year feels much better than seeing our money disappear 50% a time in some years.