There are many who are curious about the Jitta Score. How high should the score be to qualify as an attractive investment?

Actually, because the criterion in calculating the Jitta Score is set very highly, many stocks that are, in fact, good quality companies, still receive Jitta Scores that aren’t very high. And because the Jitta Score takes into account historical data of Financial Statements that date back 10 years, companies that were not able to maintain profits throughout the 10 years receive a lower score.

If you ask me, I think the companies that we can and should invest in should at least have a Jitta Score of 5 and above. Because if the Jitta Score is above 5, that means that at least that company has a quite good cash flow from it’s business. Some years, it might make a lot of profit, some years, it might not. But it almost never experiences a loss, which means the fundamentals are relatively good.

The reasons that these companies don’t have great Jitta Scores may be because, for starters, they may not be managing their profits well enough; they may have a high level of debt, they may not be effectively managing their selling prices and costs, or their business has reached a point of saturation, and so on.

The point is, if we invest in companies that have strong cash flows as a basis, and we buy them in a price that isn’t so high compared to its value, then the chances of us making a big loss are not that high.

This is the reason why I always say that before you invest in a stock, try to look at the Historical Jitta Score. If a stock’s Historical Jitta Score has been more than 5 every year, it mean that that company is a safe investment… whether the economy is good or bad, that company has alway managed to survive. Which means chances of us making a permanent loss are very small. Again, I emphasize that you have to buy it in a reasonable price as well.

If I were to roughly evaluate companies based the Jitta Score, they would be:

- Good Company: Jitta Score 5-7

- Great Company: Jitta Score 7-8

- Wonderful Company: Jitta Score 8-10

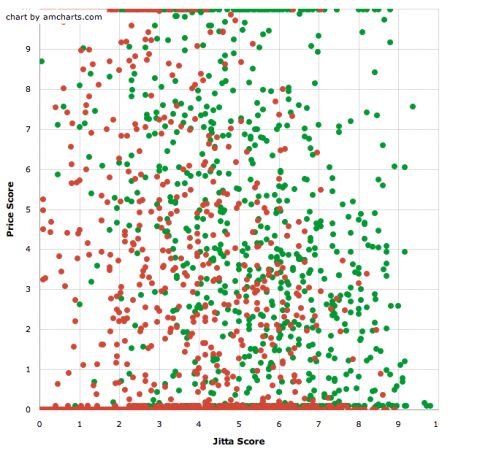

So the principle of investing, concerning what type of stock to invest in and at what price, I would like you to refer to the image in this article. For those who have studied Jitta 101, you should recall that this is the first proof, after the calculation of Jitta Score and Jitta Line of all stocks.

The X-axis is the Jitta Score, and the Y-axis is the Price Score, or the stock price compared to the Jitta Line. If it’s 5, that means the price is right at the Jitta Line. If it’s 10, that means the stock price is much lower than the Jitta Line. Zero means the stock price is much higher than the Jitta Line.

In addition, the position of each dot is the position of each stock at year end. The ones in green are the stocks that are making profits, while the red spots are ones that are making losses after 5 year.

Therefore, we can see that stocks with:

- Jitta Score 8-10: we can invest in these stocks until their prices are above the Jitta Line (Above Jitta Line 20%)

To make it simple, follow this rule:

- Jitta Score > 7 : Buy when the price does not exceed the Jitta Line

- Jitta Score 5-7 : Buy when the price is 20% lower than the Jitta Line

If you invest using this principle, you will minimize your chances of making a loss. Looking at the image, we can actually evaluate stocks in more detail. What I suggested above is merely a guideline; in your application, you can modify your strategy according to your own judgement.

Another tip is that stocks with Jitta Scores of 5-6 are ones that you shouldn’t invest in the long-run, because holding onto them for many years will not earn you super high profits. Therefore, the way to invest in these stocks would be to buy them when the prices are lower than the Jitta Line, and sell them when the prices are higher than the Jitta Line.

Furthermore, stocks that have a Jitta Score above 8 are considered high quality stocks. If you are able to buy them at reasonable prices, you should keep them in the long-term. Until the Jitta Score falls below 8 or the Jitta Line falls significantly, because these stocks are mostly companies with that are Cash Cows businesses: they’re able to earn cash and award the returns to investors in many way. Holding them in the long-run will help increase our invested capital.

Come to think about it, the fact that there are very few stocks with high Jitta Scores is actually not surprising. Because there aren’t all that many real, great businesses anyway. This is why Warren Buffet said that if you come across a truly great company, no matter what, you should not sell it, because the a great company will keep increasing its revenue and profit. The more time passes, the more its investors will benefit.

This is why Warren Buffet doesn’t trade much in a year, yet he is the richest investor in the world.