One thing that can help us improve our investment is continuous learning, especially finding explanations as to why our past investment has profited and lost, what were the components and factors for our success and failure in the past, so that we can improve our investments and decrease our chances of making a loss in the future.

I have already mentioned this in Jitta 101 that if we want to build our wealth through investing, we have to find methods of making profits. These methods have to be:

- Repeatable: if conditions are the same, the same method should be able to create profits every time (or almost every time)

- Scalable: with more money, the same method should be able to create profits in the same manner

Sounds easy, but it is something many have overlooked or never practiced, because most people in the stock market view the whole thing as luck-based, or trading stocks from insider news. So when they profit, they’re happy, when they lose money, they’re sad -no analysis on how to profit continuously.

Therefore, Jitta Portfolio has created functions that help users improve and learn from their investment strategies.

1. Gainer / Loser

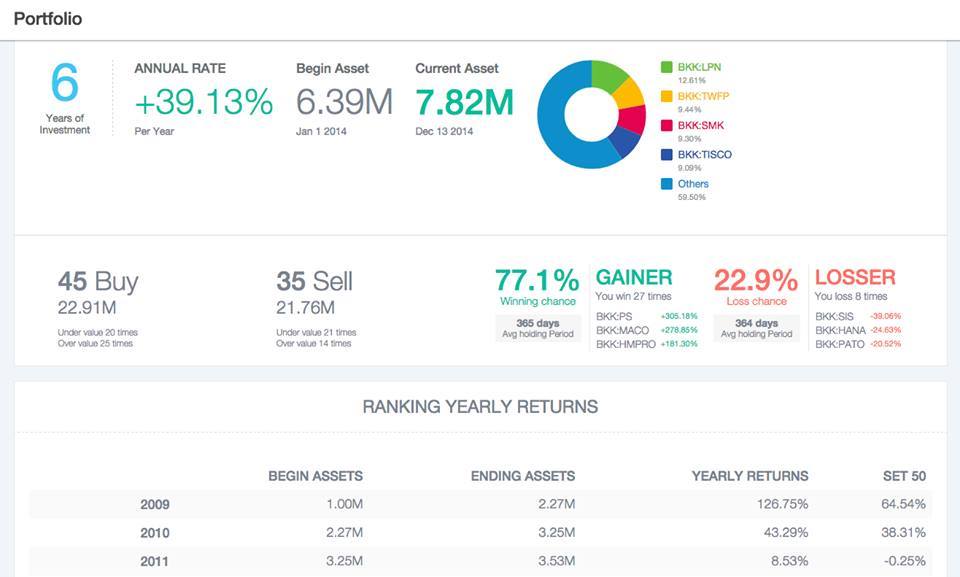

This is one of the important Statistics that tells us the amount of times we profit, ever since we started investing, and calculate the percentage of our Winning Chance (the opportunity for us to make profits) and Loss Chance. (Taking into account only the realized sales/purchases)

From the example (from the investing using Jitta Ranking since 2008), we will see that we invested 34 times, profiting 27 times; so the calculated chance of profit is 77.1%. We lost 8 times, so therefore, the loss chance is 22.9%. We can also see which are the top 3 stocks that have the highest profits and losses, and how much from each.

As Peter Lynch preached, in investment, you should profit at least 6 times from your 10-time investment. So if you have a 77.1% chance of profiting, it is considered to be quite good.

Apart from this, Jitta Portfolio also displays the Average Holding Period of the stocks that we profit and lose from, so that we can see the time period for when we made profits (i.e. around how many days), in which our example is the stocks from Jitta Ranking (holding them for 12 months); both profitable and non-profitable stocks are held around 365 days. But if somebody else has a different strategy in buying/selling stocks, this number will reflect the time period we invested that will yield the highest profit.

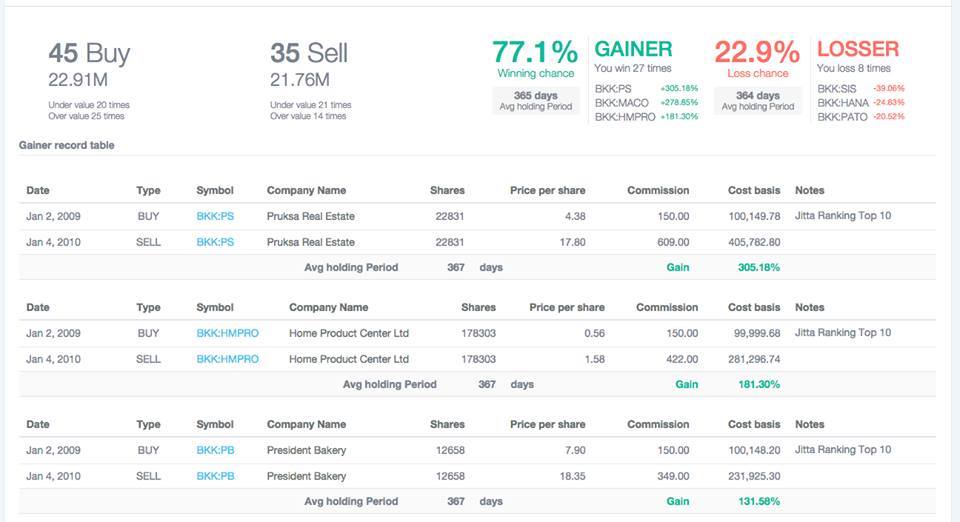

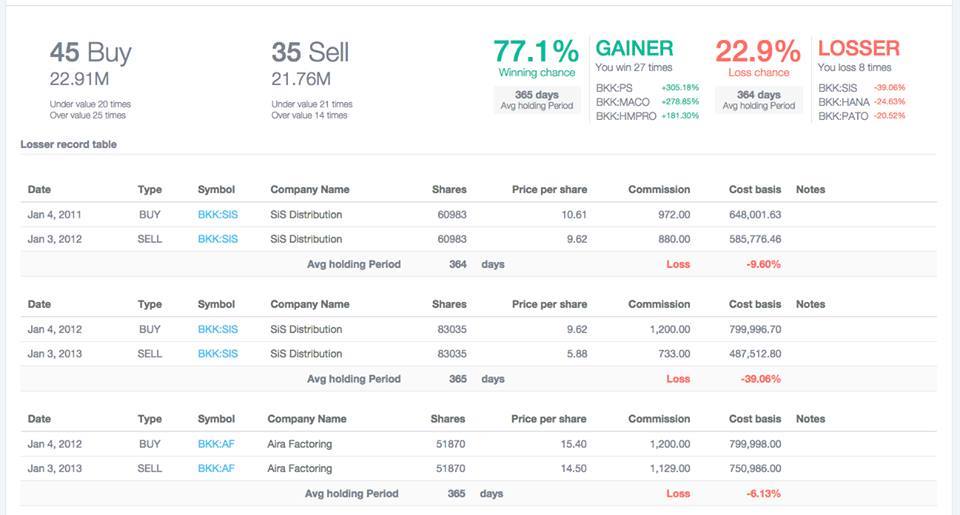

For those of you who want further details about how much we profit/lose and from which stocks in the past can click the Gainer/Loser icon on Jitta Portfolio. It will display this information.

2. Notes

In Jitta Portfolio, you can add in comments and notes in every transaction you make. So when you make profit/loss, you can see the reasons behind that, as you can record data constantly. Especially with times that we gained huge amounts or lose huge amounts, we should record the details so as to remind ourselves next time and improve our investment.

Whenever we make high profits but are unable to explain the cause, then perhaps this gain came from luck rather than skill. When we make huge losses and are unable to explain them, it shows that we lack skills or made a wrong decision (not because of bad luck).

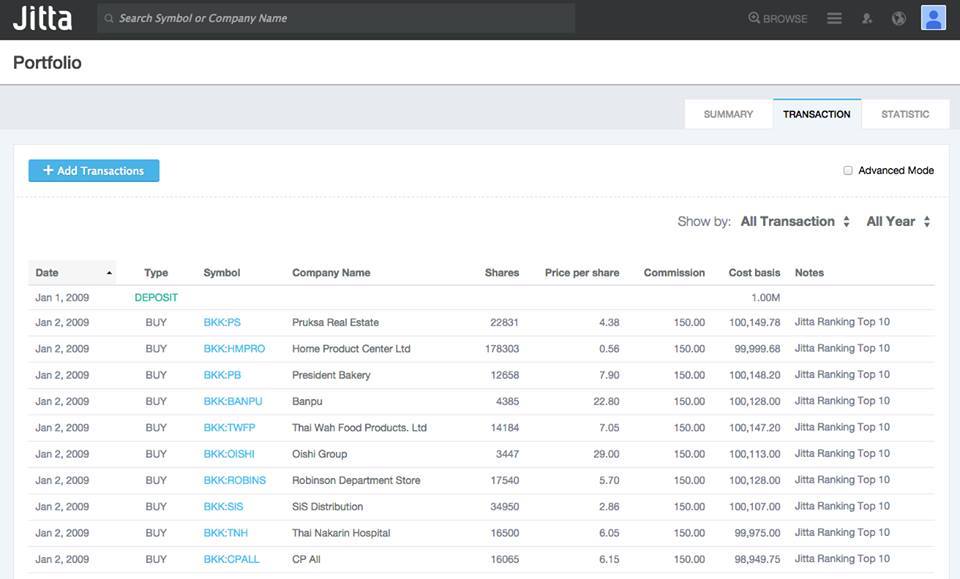

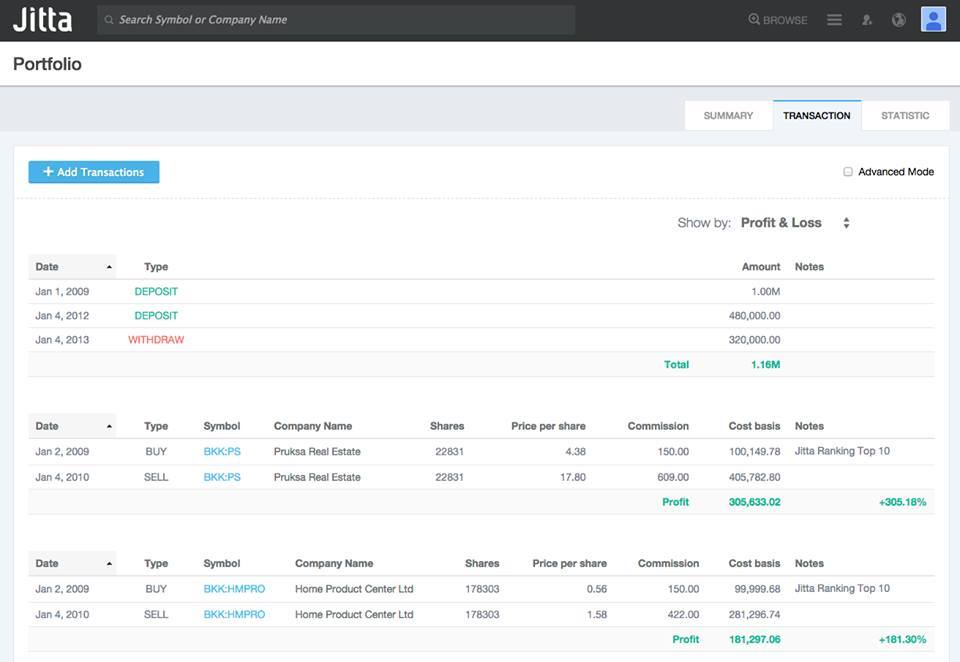

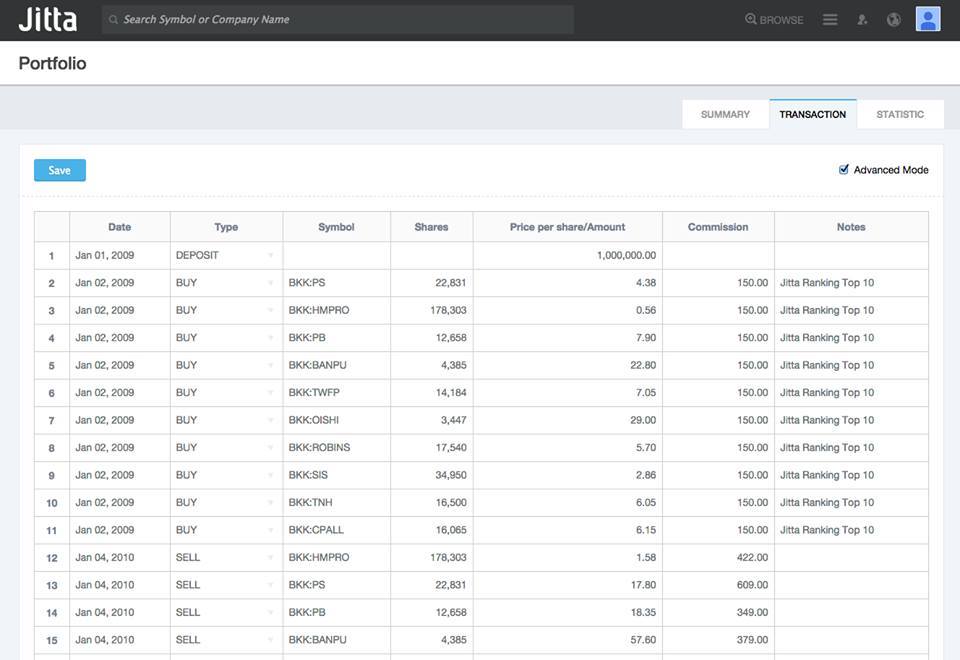

3. Transaction History

For those who want to view their entire investment history, Jitta Portfolio has the Transaction History function for you to revert back and study each year carefully -what happened with your investment, which are the years we made losses, and why (we can read from our Notes).

Within Transaction History, we can view two types of information:

All Transactions : showing all of your transactions by order

Profit/Loss : showing your history of transactions by individual stocks, so that we will know how much profit/loss we made from each stock

(In addition, you can choose the Advanced mode on the Transaction page, for those who want to add or alter other information)

__

With all this, we would be able to record all our investment history, and can access them to learn, find strong and weak points in our investments in the Jitta Portfolio.

And that’s the end of our Jitta Portfolio Series! For those of you who haven’t read the previous ones, you can do so at these following links:

Jitta Portfolio Series # 1 : Portfolio Management

http://library.jitta.com/en/article/jitta-portfolio-series-1-portfolio-management

Jitta Portfolio Series # 2 : Asset Allocation

https://library.jitta.com/en/article/jitta-portfolio-series-2-asset-allocation

Jitta Portfolio Series # 3 : Tracking Your Results

https://library.jitta.com/en/article/jitta-portfolio-series-3-tracking-your-results

After studying up on how to manage, plan and improve your Portfolio, I have no doubt that everyone can learn from and improve their investment strategies for the future.