In this article, we will look at another important aspect of investment. It’s Asset Allocation -how should we diversify our investments in different stocks?

Most people do not have a clear set plan, causing their investment proportions to be in disarray, and in the end, their return might not be so great, especially when the port grows bigger and bigger. Therefore, these are the things we have to consider in Asset Allocation:

Look at everything in percentage (%), not in monetary value

When we have $10,000 of investment capital, and we buy one stock for $5,000, we might feel indifferent because it is just $5,000. It’s not a big loss if something happens. But if we have an investment capital of $10 million, buying $5 million worth of one stock seems very risky, because if something goes wrong, that means our 5 mil will be gone.

In reality, these two cases have the same amount of risk, because we are using 50% of our capital in both cases. In Warren Buffett’s case on the news, where he lost 2 billion USD. from stocks… seems like a LOT of money right? In reality, he has over $67 billion worth of portfolio. Losing $2 billion is actually around 3% of his port, and really not that big a deal.

So when we are evaluating our return or looking at our investment proportions, we should calculate by percentage including our cash in the port. This makes our evaluation much clearer, and reduces problems in allocating our wealth when our port grows bigger.

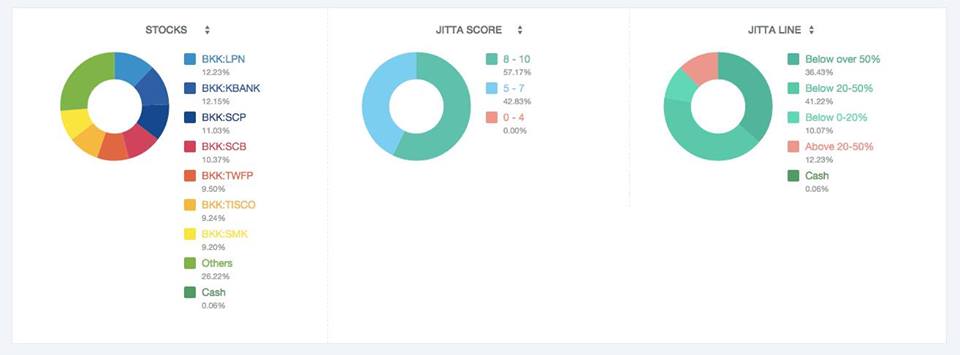

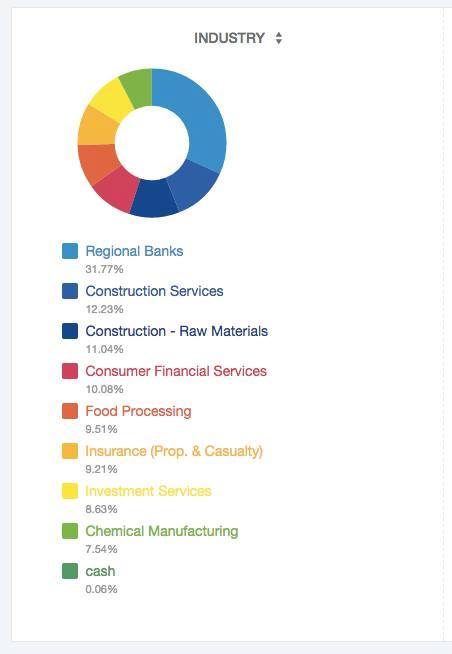

In Jitta Portfolio, Asset Allocation is clearly displayed in percentage form, at the bottom of the Portfolio. There are 3 types information:

- Asset Allocation for the type of stocks: Stock Symbol, Industry, Sectors

- Asset Allocation for the company fundamentals: Jitta Score and Jitta Line

- Asset Allocation for the expensiveness/cheapness of stock: % Above/Below Jitta Line

This will allow us to effectively manage our investments, setting an investment strategy and proportion to match with the level of risk and confidence we have. Once we look at our investment in percentage proportions, what we need to do next is set a strategy and allocate proportions of our investments.

For example, setting a minimum and maximum for our investment capital (% of the total investment capital). Most people do not plan their investment proportions, so they often encounter situations where they miss out on buying good stocks in large amounts, while end up buying a lot of the bad stocks, causing their portfolio to lose money.

For example

- A certain stock can have a 100% profit, but if we invest only 5% of our port in that, then we would only make a 5% profit overall

- A stock has a 50% loss, and we invested 20% in it, resulting in a total loss of 10%; and when combined with the first stock, we find that we are at a 5% loss overall

This is why we should set the minimum and maximum proportions that we will invest in, to get good returns while diversifying the risk.

As for the minimum proportion we should invest in a stock, according to Buffett’s principle, if you are still not sure whether you want to invest 10% of your money into that stock, then you shouldn’t invest even a single penny in it. Because if you diversify too much, even though some stocks gain lots of profit, it wouldn’t help grow your port by much.

Therefore, the minimum proportion to invest in each stock should be around 10% of your total investment capital at the point.

If, in case you find Stock A to be excellent, but you only have 5% of your port’s money to invest, what you should do is compare Stock A to other stocks in your port, then sell the ones that have lower quality and value than Stock A to liquidate the money to buy more of Stock A. This will allow you to invest in Stock A in proportions that you wanted, and increase the opportunity for your port to grow bigger in the long-run.

If you are extremely confident in particular stocks, you can invest more than 10%; however, how much more depends on your confidence. If you are super confident, then you might put in even up to 50%, but again, also look at the risk factor when deciding.

In my case, the highest percentage I would go is around 30% of my port, because even if that stock makes a 50% loss, overall my port would only lose 15%. But generally, the stocks that I invested quite a lot in have minimal chances of making a loss, as they’ve been thoroughly analyzed before buying to begin with. And so for them to make a loss of 50%, that almost never happens. If there were to be a misjudgment, it usually stays around 20%, which amounts to no more than 6% of the port.

Of course, this is only taking into account of a bad decision stock pick and selling it out -not taking into account that the stock price has fallen because of market conditions; because in that case, the price would rise again when conditions are better. Aside from calculating the minimum of spending on each stock, we also need to calculate the maximum spending in each industry as well, for example no more than 40% of our port, to minimize the risks associated with that industry.

When we have an appropriate mix of stocks in our port, look at the overall return. We would be much happier, because when we make a loss on individual stocks, it might not even affect the big picture of our investment. Actually the Jitta Strategy suggests to newcomers that the easiest way to invest is to invest in 5 to 10 stocks, averaging their proportions, making your investment money in each stock at 10-20%, which is quite a good strategy to begin with.

Analyze and set the level of strength of your portfolio in your preferred format.

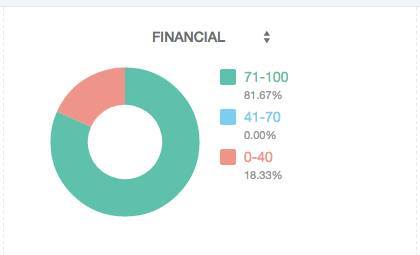

In Jitta Portfolio’s Asset Allocation Pue Chart (of Jitta Score) will help you to easily adjust the port because we can see how “mother company” (your port) has spread out in terms of asset allocation, and in which aspects is it particularly strong in. If we approach this with a business perspective, evaluating the big picture of our port will be much simpler, because we can analyze the strengths and weaknesses of our port: how strong do we want our subsidiaries to be, in which aspects, and how much, etc.

For example, if we want to avoid cash flow issues in our port, we should manage the port so that it has a high Financial Strength. You will see that in the image, 81.85% of your investment capital is in assets that have a Financial Strength of 71-100, which means that no matter what happens, we almost don’t have to worry about our ‘subsidiaries’ being short on money in their operations. Setting proportions is subjective to each individual. We do not even need to set proportions to some; or some people might just set proportions based on Jitta Score of more than 5 -this works as well.

In addition to setting proportions of the Jitta Score and Jitta Factor, we can also look at the Jitta Line Pie Chart to see the risk level -how hard can we fall. if most of our money is in assets that cost less than their values, even if the stock market falls, our port wouldn’t be that affected (mind you, these assets would have to have a good quality of course).

Whenever your money is in assets that are Above Jitta Line, we should decrease our port’s risk level by selling out some stocks that do not have good quality and are more expensive than their suitable value. So you should make this decision based on analyzing the Asset Allocation Pie Chart and the Fundamental page.

Lastly, do not forget to key in the cash amount that you put into buying the stocks!

P.s. For those who haven’t yet used the Jitta Portfolio, you can access it at: http://www.jitta.com/portfolio (applicable to only Jitta members)

P.p.s. If you would like to read other Jitta Portfolio Series, you can do so at these following links:

Jitta Portfolio Series # 1 : Portfolio Management

http://library.jitta.com/en/article/jitta-portfolio-series-1-portfolio-management

Jitta Portfolio Series # 3 : Tracking Your Results

https://library.jitta.com/en/article/jitta-portfolio-series-3-tracking-your-results

Jitta Portfolio Series # 4 : Learning from your past investments

https://library.jitta.com/en/article/jitta-portfolio-series-4-learning-from-your-past-investments

P.p.p.s You can also watch the Jitta Portfolio Introductory Video